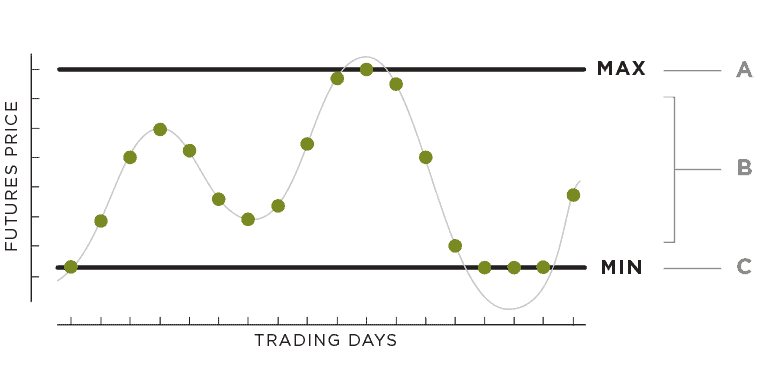

Our Freedom® Min/Max Average℠ program establishes both a minimum and maximum hedge price at the start of the pricing window.

A. If the market settlement goes above the maximum, that day’s value is set at the maximum price.

B. If the market settlement is anywhere in-between, that day’s value is set at the day’s market settlement price.

C. If the market settlement falls below the minimum, that day’s value is set at the minimum price.

![]() Final pricing is determined by the simple average of each daily price.

Final pricing is determined by the simple average of each daily price.

PRICE ADJUSTMENT

Dependent on minimum and maximum price levels vs. the market.

Price Adjustment quoted per bushel.

Pricing window and futures reference subject to daily quotes.

All bushels are guaranteed to price. Basis may be attached at any time during the pricing period.

Standard HTA policies and fees may apply.

All futures positions and program costs are in USD and will be converted to CAD at the time of contract pricing

For more information please contact:

Heather Moffatt

Grain Originations Manager

hmoffatt@theandersons.com

Cell: (519) 525-8148

Jennifer Kilbourne

Grain Originations

jkilbourne@theandersons.com

Cell: (519) 401-7220

Freedom Structured Pricing Tools take the emotion out of your grain marketing decisions with automated, rules-based programs that work without trading discretion. With a Structured Pricing Tool, you will know how each product will perform in all market scenarios. These programs provide the ideal combination of convenience and customization.

Available Freedom Programs: